How Young Families Should Prepare for Their First Home Purchase

Ownership your first home is a milestone for any new, immature family unit, whether you're newlyweds nonetheless on your own or you're bringing a few little ones in tow. You need space to let your family grow and flourish, and the best garden for new families exists in your own abode, where you won't have to worry about landlords or picking up stakes later on your lease. That said, planning for a home is no piece of cake task–although going about it the correct manner makes the endeavor run much more smoothly.

Think Almost Your Dream Business firm

Family planning is a huge issue when you're ready to buy a abode. You have to think about the size of your family considering y'all don't want to have to upgrade in a few years, sell your current dwelling house, and start the process over once more. Do you plan to stay child-costless or practice you dream of a house full of children? Maybe two or iii is your perfect number. Whatever the case, budget for bedrooms, bathrooms, and the perfect amount of infinite.

Y'all likely have some necessities as well. What's most important to you? Are you flexible on location, or are you determined to stay in, say, Tampa or Naples? Practise you want a dwelling in the metropolis or a firm surrounded by greenery? Think well-nigh both the luxuries and the essentials, such equally:

- The number of floors

- The number of bathrooms and bedrooms

- A big yard

- A ranch vs. a colonial

- And the overall age of the abode

Examine the Employment Situation

If you don't have steady employment, you may want to think twice near buying a house. You don't want to get stuck with a mortgage that you tin can't pay. If your job is on the fence or you're constantly changing careers, you might need to wait. As well, you should make up one's mind if both of y'all demand to work. A single-income family unit situation might not piece of work for the house of your dreams, even if your desires are flexible.

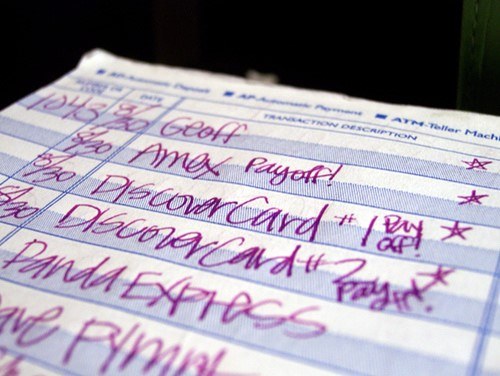

Get a Handle on Your Debts

Your debts weigh heavily on your credit score. Are y'all in default on any of your schoolhouse loans? Is there a credit card y'all've neglected to pay off that's now coming dorsum to haunt you? Before you even go run into the bank or any lenders, cheque out your credit score. To determine your credit score, several aspects factor in:

- Your payment history

- The amount yous owe

- The length of your credit history

- Any new credit

- The types of credit

Don't start opening credit accounts all over the place to boost your FICO score either. That will look even worse, and it will affect your mortgage rate. To get a good mortgage rate, you need a high credit score. At some lending offices, a credit score between 625 and 650 will get you a decent charge per unit. If you want better options for financing and enviable interest rates, you need a score of 700, at least.

If yous fear your FICO score doesn't pass muster, all hope isn't lost. Start paying off your debts at present. Use the snowball method if you have to, and pay off the card with the highest interest rate beginning, and then work your way down the listing.

Piece of work Out Your Mortgage Management

The housing marketing is always on the rise and fall. Buying a dwelling is a nifty thought at present, considering the housing industry is hot. Houses are being sold at lower rates for numerous reasons. That can work very well with your chances for an affordable mortgage rate through www.foundationmortgage.net. You can talk to someone at your local banking company or other fiscal institution to see about your options. If the rates you're quoted scare you, simply remember this: having a mortgage is the aforementioned matter as paying rent, except you're paying yourself to own your home. Your mortgage and involvement rates create equity, which you can borrow from in times of trouble and write-off every bit a tax deduction. Be conscientious when doing this, you don't want to borrow more than than you can afford.

There are x.ii per centum more single-family homes for sale in Florida than at that place were terminal year. That increases your chances of finding your dream abode, but it will likewise assist you become a better mortgage rate. The law of supply and demand that made good rates so hard to come past during the housing crisis is finally starting to calm down. Yous only accept to work out what kind of mortgage works for you:

- A stock-still-interest mortgage, which keeps your interest the same for life

- An adaptable-rate mortgage, where the rate changes every year

- Or an involvement-only loan, which helps if y'all need a low payment in the showtime

Stay Within Your Budget

That being said, you still need to stay within your upkeep. Moving is a large deal anyway; simply the toll of moving from a rental to a abode yous ain will cost a packet, especially if you need new furniture. Program to spend anywhere between $five,000-$10,000, depending on where you're going, what you own, and what y'all can do yourself. You can't forget nigh broker'due south fees, closing fees, and deposits, either, specially since the average cost of a dwelling house in Florida is upward to $194,000.

Research Your Loan Options

Whether you're going for a Tampa mortgage, a Naples mortgage, or a straight Florida refinance programme, at that place are lots of loan options bachelor to y'all. For instance, FHA loans come up from the Federal Housing Administration, which backs y'all on insurance as long equally y'all meet the qualifications. VA loans are available to agile members of the armed forces as well as eligible veterans. There are too loans from the government and housing offices in your local area, especially for people buying a home for the first time.

Think Outside the Traditional Box

If you're thinking well-nigh an FHA loan, then realize that various HUD homes through the Department of Housing and Urban Evolution might become available to yous. You have to encounter strict qualifications, merely they're worth looking into if you lot're having trouble getting a loan. You tin even call back about looking at foreclosed homes in your area, which may cost much less than other homes.

Buying a domicile for the first time is scary but it'due south as well exciting; it's one of the all-time investments you lot'll ever brand. Are y'all ready to take the plunge?

Source: https://www.lifehack.org/articles/lifestyle/how-young-families-should-prepare-for-their-first-home-purchase.html

Belum ada Komentar untuk "How Young Families Should Prepare for Their First Home Purchase"

Posting Komentar